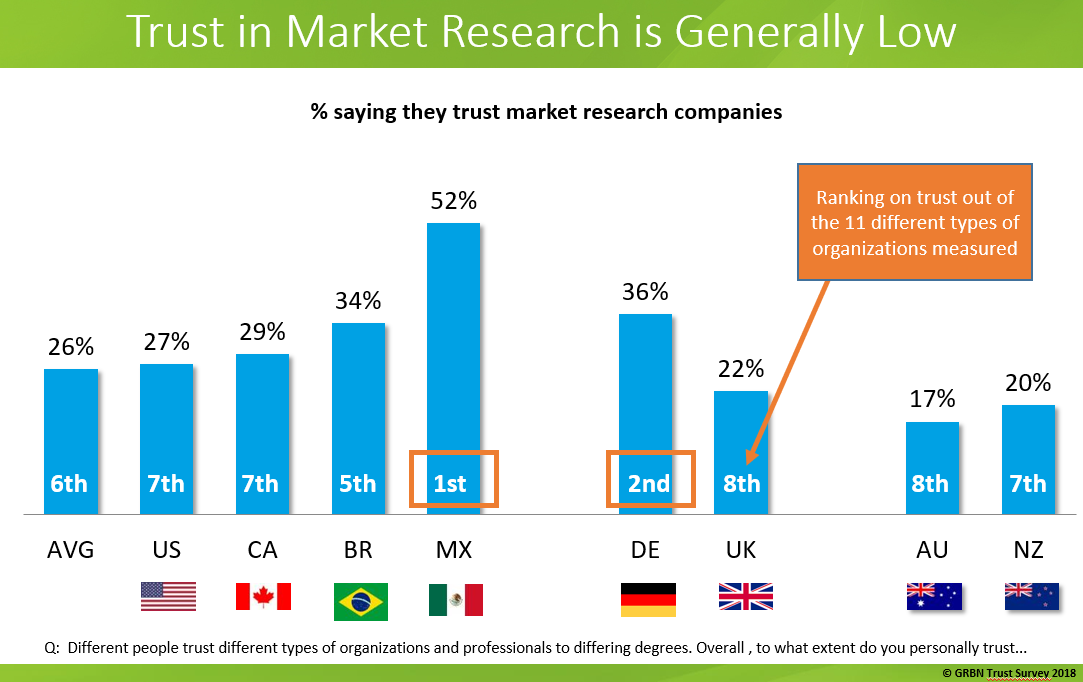

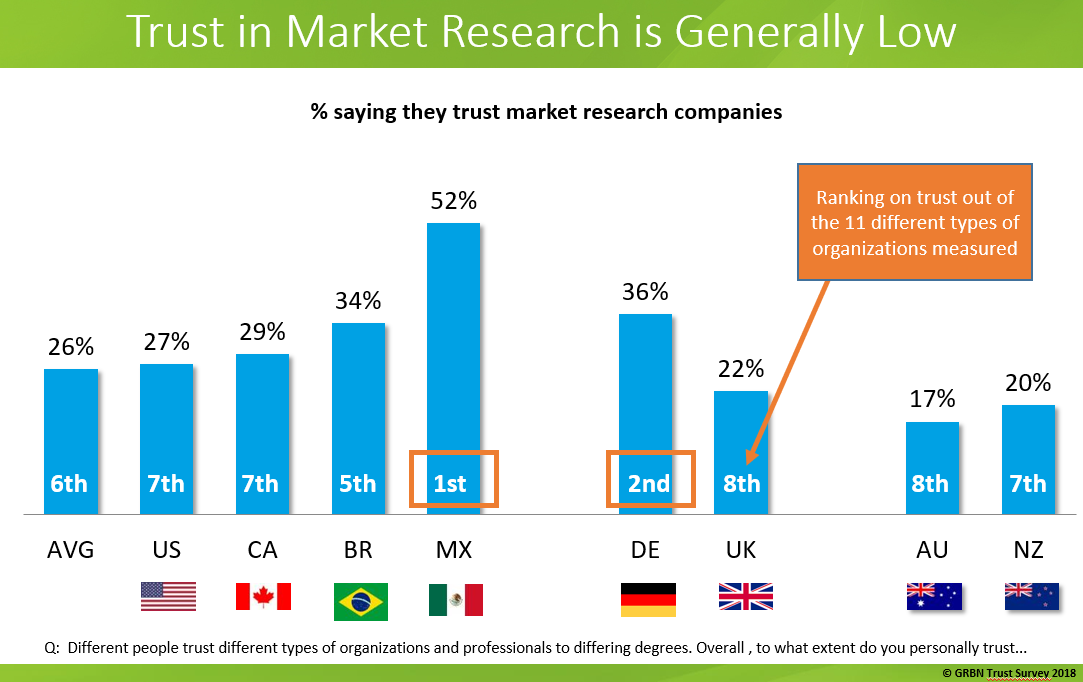

That we must try harder is the key take-away from the GRBN 2018 Trust Survey. On average across the eight countries we looked at, only one-in-four of the people we surveyed said that they trust market research companies. This is simply not good enough if we expect people to willingly participate in research.

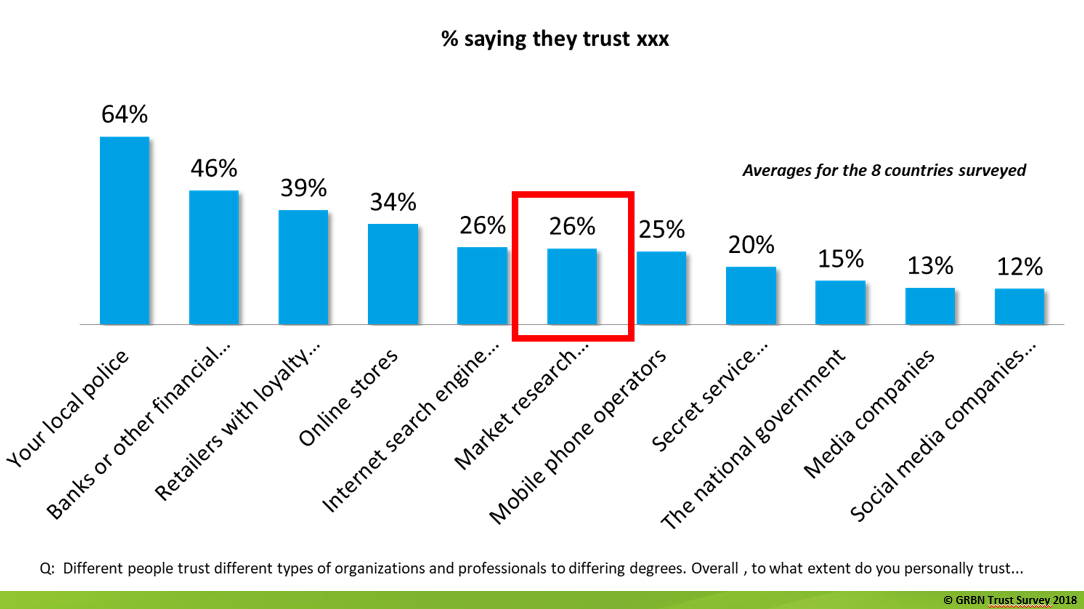

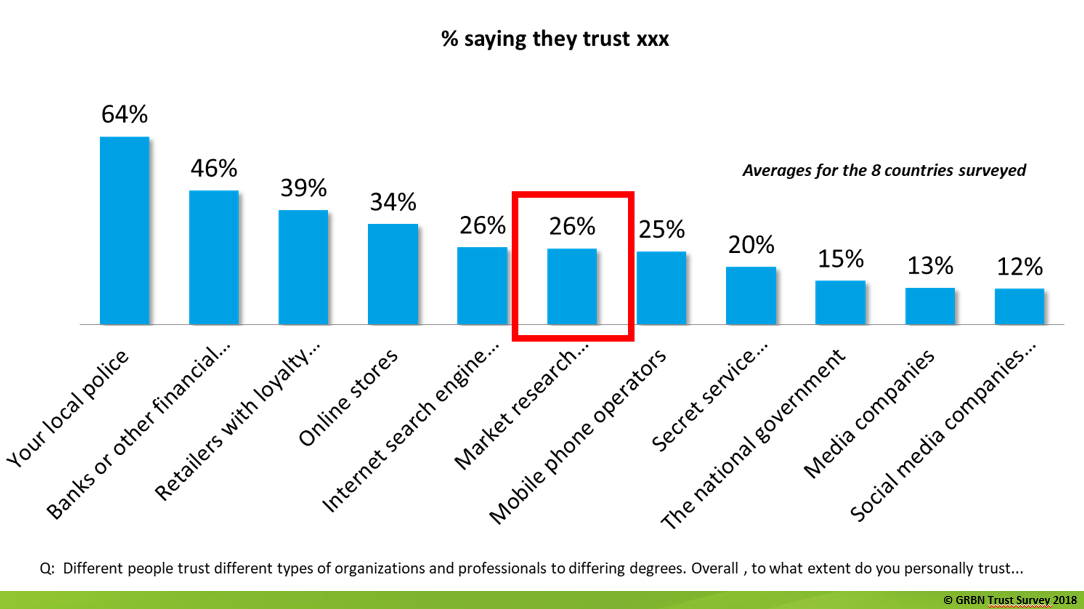

Out of the 11 different types of organizations surveyed, market research companies are ranked 6

th overall. Not bad, but not good. People have a similar level of trust in internet search engine (e.g. Google / Bing) providing companies and mobile phone operators. Whilst we are certainly more trusted than government, media companies and social media companies, we don’t see this as much as a consolation prize.

You may argue that being as trusted as internet search engine companies is good enough, and on one level we agree. You have to remember, however, the strong value proposition that these companies offer, and ask yourself do market research companies provide the same value exchange. We would argue that they do not, and as a result need to have a much higher level of trust if we are to expect people to engage willingly with market research companies.

Germany and Mexico are beacons of lights

The average ranking of 6

th hides significant variation across the eight countries. In Mexico, market research companies are ranked 1

st on trust out of the 11 different types of organizations we looked at, and in Germany they are ranked 2

nd. In other countries, the situation is a lot darker, and in Australia, New Zealand and the UK a higher proportion of the people surveyed said they distrusted market research companies than said they trusted them.

What is driving low trust in market research companies?

It is well documented from other research into the issue of trust, that we live in a low-trust world: Low trust in institutions, big business, experts… Our own survey shows, for example, that the level of trust in government across these countries is alarmingly low. You can read our article ‘If You Don’t Trust Your Government Who Can You Trust?‘

here. The low level of trust in market research companies is no doubt influenced by these things, but we do see other factors, which are also influencing the level of trust people have in market research companies specifically.

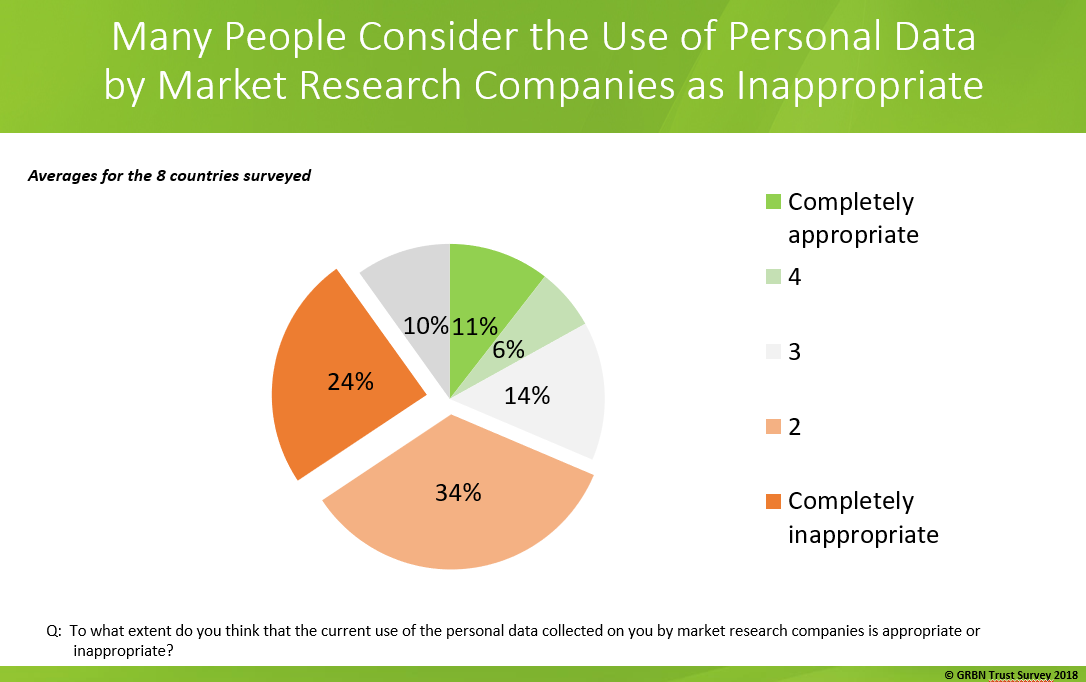

Driver no.1 = Mistrust with Personal Data Use

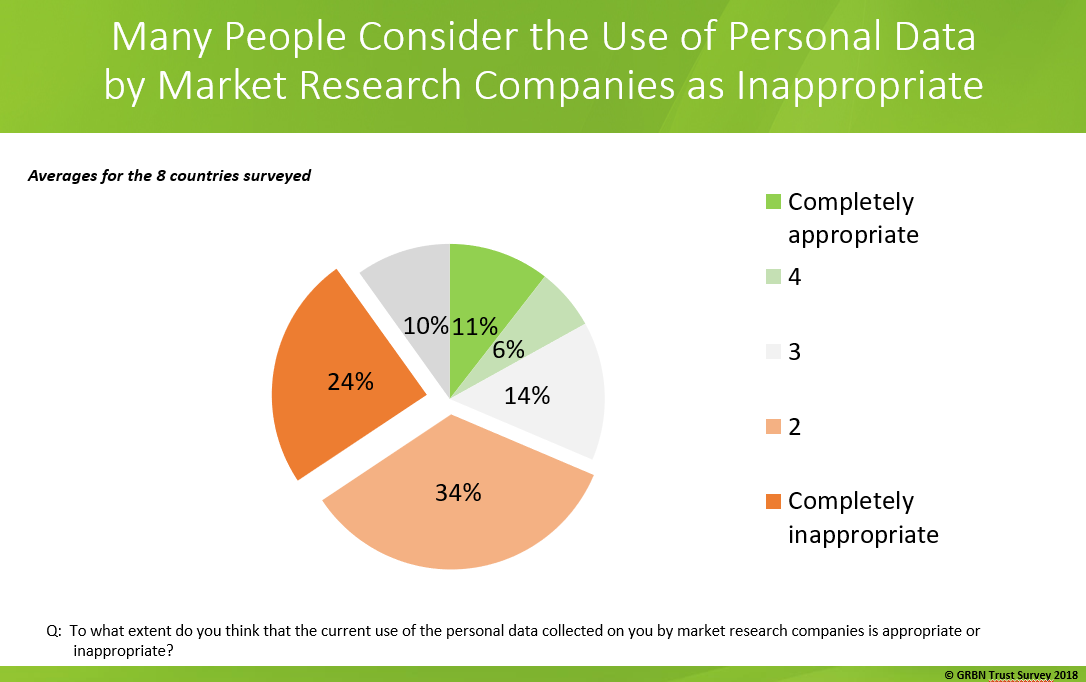

Firstly, we see a low level of trust concerning how market research companies are collecting and using personal data. Market research companies collect a lot of data, of course, including a large amount of personal information, much of which we know from earlier research that people consider to be sensitive personal data. Somewhat alarmingly, we continue to find that many people (who are taking surveys) do not consider the use of their personal data as appropriate.

We see at least a couple of reasons for this. Firstly, many people feel badly informed by market research about how their personal data is collected, stored and used. Secondly few people feel that participating in research benefits them as either citizens or consumers, with business being seen as getting the benefits. This lack of understanding combined with a lack of perceived value of participating in research no doubt negatively influences whether the use of one’s personal data is considered to be appropriate or not.

Driver no.2 = Bad experiences

Our earlier research showed that as many as seven-in-ten survey-takers have had bad survey experiences recently. In our opinion, there cannot be a relationship built on trust so long as we continue to give people a poor experience when they participate in research.

Our research shows that there are at least three factors causing a bad experience:

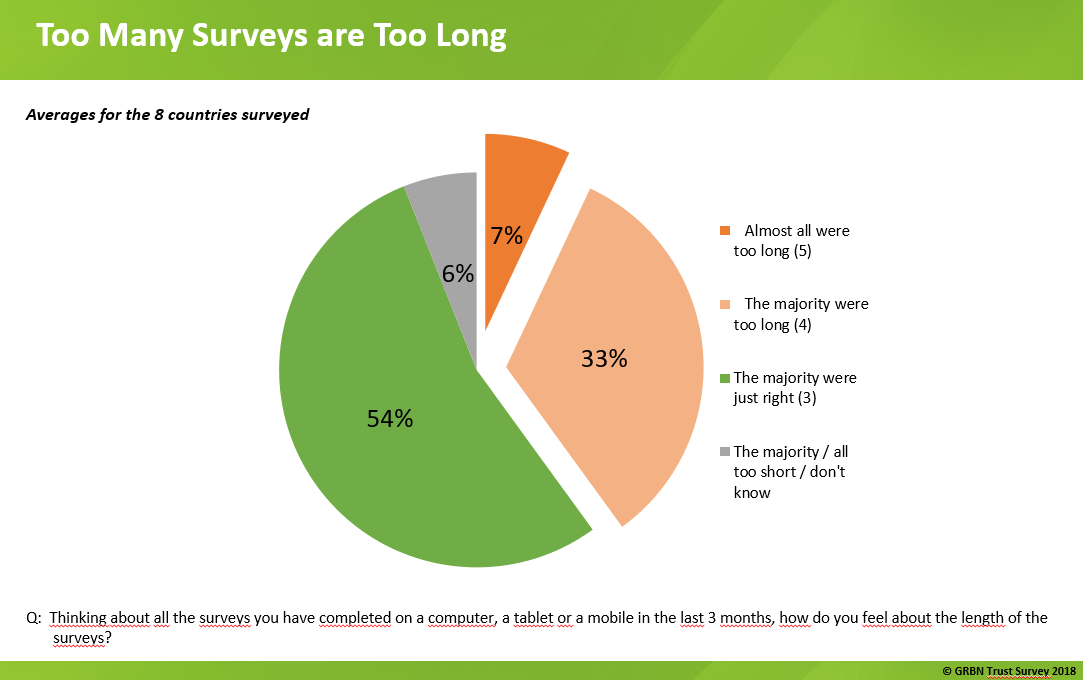

- Long surveys

- Low enjoyment surveys

- Poor mobile design surveys

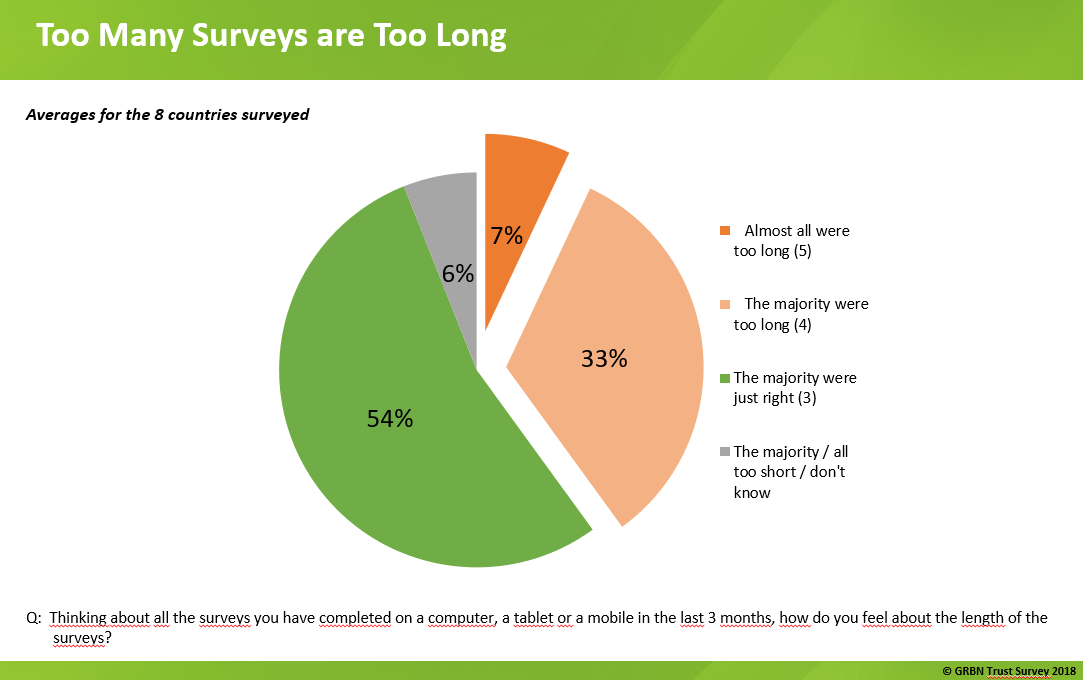

Surveys are perceived to be too often too long. Data we have received from colleagues on the sample supplier side shows that the average length of the surveys people are asked to participate in continues to be over 20 minutes. We would argue that those people who aren’t regularly taking surveys, would be even more likely to find these 20 plus minutes surveys to be too long.

Secondly, we are too often not giving people an enjoyable survey experience. From our earlier research into the online survey user experience, we found many factors contributing to the fact that we are giving people a poor user experience. You can read insights from that research

here.

Thirdly, a lack of design for mobile is causing a poor use experience to the increasing number of people who are taking surveys on their smartphone. People are used to getting great user experiences on their smartphones when they use other apps / access other websites, so they are no doubt even more frustrated and disappointed when they get a poor experience when trying to take a survey on their smartphone.

A simple choice to make

In light of these findings, we have a simple choice to make. We can either shrug our shoulders and do nothing, or we can act. We, at GRBN, are firmly in the ‘we need to act’ camp, and you can

read why we think you should be too here.

You can also

read about our plans to change things here.

If you’re already convinced about the need to act,

please get in touch so we act together and amplify the impact we can have.

Thanking our partners

We would like to take this opportunity to thank our partners on the Trust Survey without whose generous contributions we would not have been able to conduct this research.

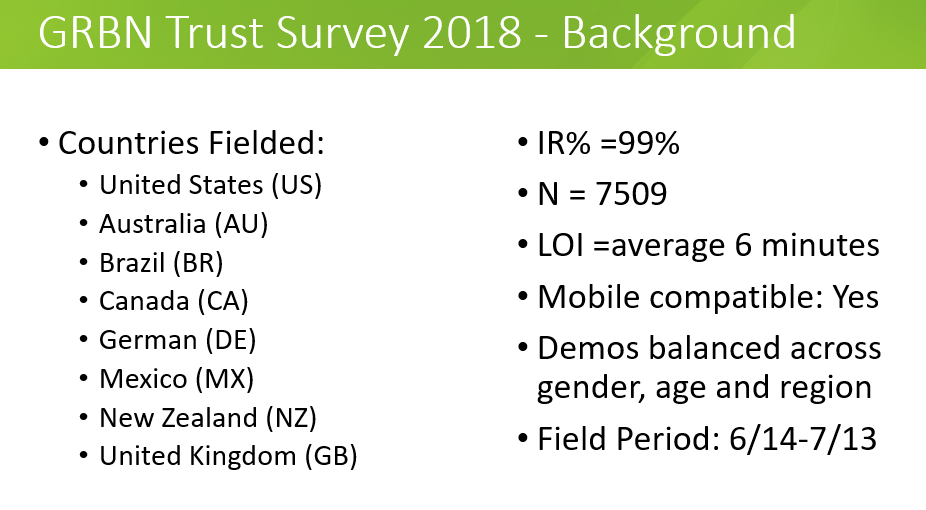

About the GRBN 2018 Trust Survey

About the GRBN 2018 Trust Survey

Out of the 11 different types of organizations surveyed, market research companies are ranked 6th overall. Not bad, but not good. People have a similar level of trust in internet search engine (e.g. Google / Bing) providing companies and mobile phone operators. Whilst we are certainly more trusted than government, media companies and social media companies, we don’t see this as much as a consolation prize.

Out of the 11 different types of organizations surveyed, market research companies are ranked 6th overall. Not bad, but not good. People have a similar level of trust in internet search engine (e.g. Google / Bing) providing companies and mobile phone operators. Whilst we are certainly more trusted than government, media companies and social media companies, we don’t see this as much as a consolation prize.

You may argue that being as trusted as internet search engine companies is good enough, and on one level we agree. You have to remember, however, the strong value proposition that these companies offer, and ask yourself do market research companies provide the same value exchange. We would argue that they do not, and as a result need to have a much higher level of trust if we are to expect people to engage willingly with market research companies.

You may argue that being as trusted as internet search engine companies is good enough, and on one level we agree. You have to remember, however, the strong value proposition that these companies offer, and ask yourself do market research companies provide the same value exchange. We would argue that they do not, and as a result need to have a much higher level of trust if we are to expect people to engage willingly with market research companies.

We see at least a couple of reasons for this. Firstly, many people feel badly informed by market research about how their personal data is collected, stored and used. Secondly few people feel that participating in research benefits them as either citizens or consumers, with business being seen as getting the benefits. This lack of understanding combined with a lack of perceived value of participating in research no doubt negatively influences whether the use of one’s personal data is considered to be appropriate or not.

Driver no.2 = Bad experiences

Our earlier research showed that as many as seven-in-ten survey-takers have had bad survey experiences recently. In our opinion, there cannot be a relationship built on trust so long as we continue to give people a poor experience when they participate in research.

Our research shows that there are at least three factors causing a bad experience:

We see at least a couple of reasons for this. Firstly, many people feel badly informed by market research about how their personal data is collected, stored and used. Secondly few people feel that participating in research benefits them as either citizens or consumers, with business being seen as getting the benefits. This lack of understanding combined with a lack of perceived value of participating in research no doubt negatively influences whether the use of one’s personal data is considered to be appropriate or not.

Driver no.2 = Bad experiences

Our earlier research showed that as many as seven-in-ten survey-takers have had bad survey experiences recently. In our opinion, there cannot be a relationship built on trust so long as we continue to give people a poor experience when they participate in research.

Our research shows that there are at least three factors causing a bad experience:

Secondly, we are too often not giving people an enjoyable survey experience. From our earlier research into the online survey user experience, we found many factors contributing to the fact that we are giving people a poor user experience. You can read insights from that research here.

Thirdly, a lack of design for mobile is causing a poor use experience to the increasing number of people who are taking surveys on their smartphone. People are used to getting great user experiences on their smartphones when they use other apps / access other websites, so they are no doubt even more frustrated and disappointed when they get a poor experience when trying to take a survey on their smartphone.

Secondly, we are too often not giving people an enjoyable survey experience. From our earlier research into the online survey user experience, we found many factors contributing to the fact that we are giving people a poor user experience. You can read insights from that research here.

Thirdly, a lack of design for mobile is causing a poor use experience to the increasing number of people who are taking surveys on their smartphone. People are used to getting great user experiences on their smartphones when they use other apps / access other websites, so they are no doubt even more frustrated and disappointed when they get a poor experience when trying to take a survey on their smartphone.

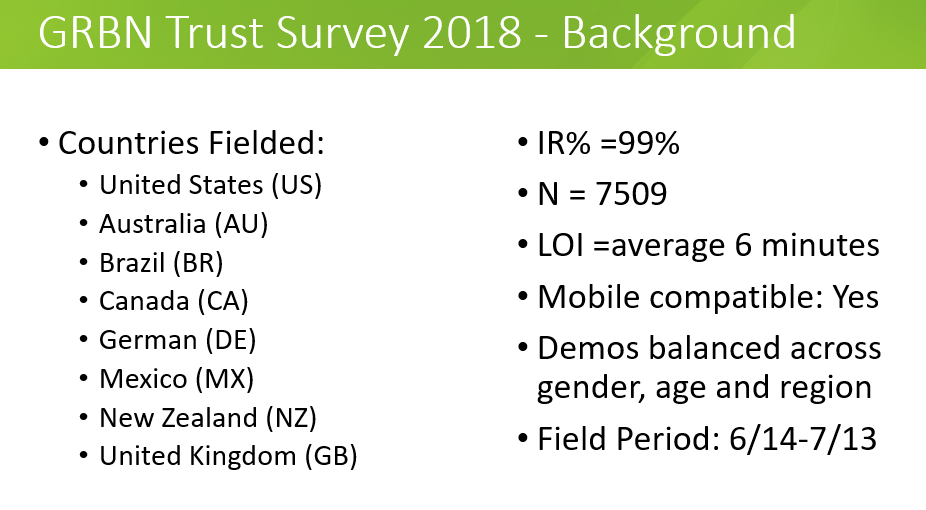

About the GRBN 2018 Trust Survey

About the GRBN 2018 Trust Survey